The enrichment of the previous Welfare offer includes services aimed at increasing purchasing power. This includes a utility bill reimbursement, fuel vouchers, degree redemption contribution, mortgage portability with subsidised terms for employees, interest-free instalments on purchases with Flexia card and a 50% discount on My Care Family policy. In addition, in December 2022, an inflation bonus of €800 was credited to the Welfare Account, to guarantee an immediate recovery of purchasing power, through reimbursements of bills, shopping and fuel vouchers.

Moreover, Welfare Reconnect aims to reconcile professional and private spheres, offering flexibility and caring initiatives for individuals, families, and communities, including: Spazio per Te, a new counselling and psychological listening service, Prevenzione per Te, Uni.C.A., a check-up campaign and webinar on primary prevention, and study/work orientation paths to support employees’ children in choosing their future. Lastly, the offer keeps people top of mind. It enhances new skills and fosters an environment to grow and create value focusing on education, such as the “Let’s Make the Invisible Visible” programme to shed light on invisible disabilities and Welfare Talks to delve into issues employees are facing both personally and professionally.

A conversation with...

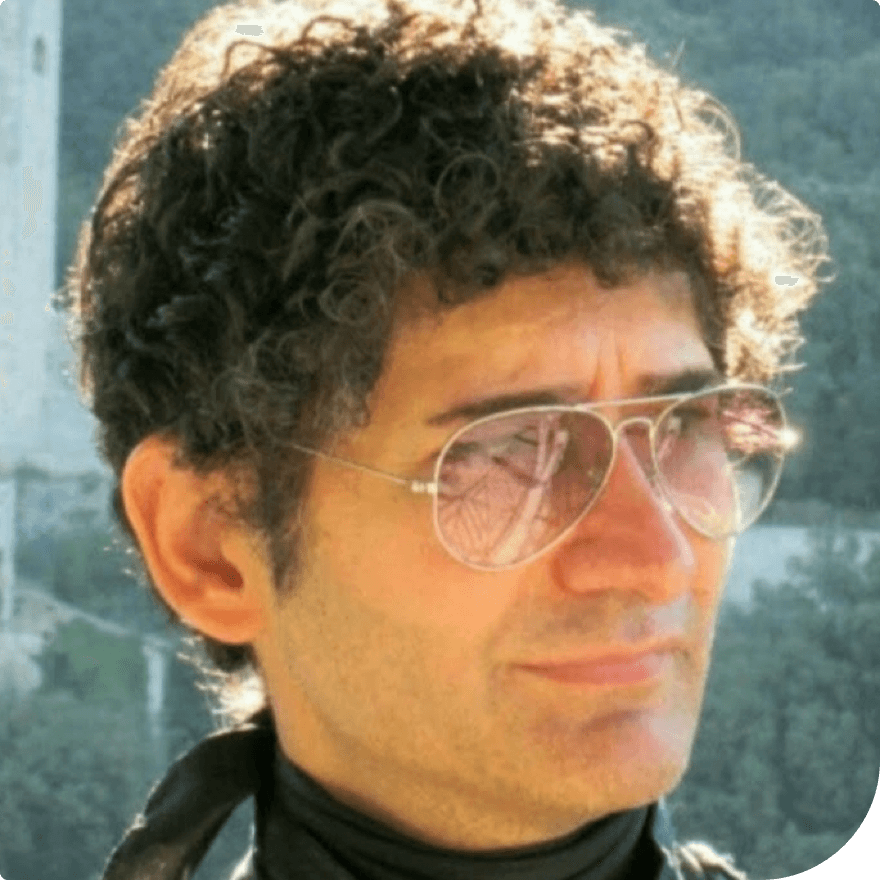

Fabio Giordani, Small Business Assistant, South of Lazio (Central Italy)

For you, what has Welfare Reconnect meant for UniCredit?

Fabio Giordani,

Small Business Assistant, South of Lazio (Central Italy)

For UniCredit, I believe the Welfare Reconnect project means reconnecting with our people, putting them at the forefront, ensuring fulfilment in their own social context – whether that’s through promoting healthy working relationships, supporting their education, or creating an effective connection with the community which they belong to.

For a company like Unicredit, wanting to fully integrate an individual in his or her working and social environment means paying attention to the person's needs with dedicated support, ensuring they feel part of something bigger, looking at the overall profile and not just the work performance aspect.

A remarkable example of this is the attention paid to diversity, and therefore to disability, in order to shape (both in terms of thought and practical needs) a corporate culture increasingly in-line with a new general vision for our bank.

Why are you particularly proud to have worked on the "Let's make the Invisible Visible" project?

I believe that being able to raise awareness of invisible disabilities is an important step in our bank’s forward-moving direction. Being a "Disability Advocate", as an active member of the National Working Table of UniCredit (Disability Employee Resource Group) on Invisible Disability, I find it a valuable opportunity to act as a protagonist and play an active part in promoting meaningful change.

How has this project enabled us to deliver on our Purpose: Empowering communities to progress?

I am convinced that dialogue and confrontation, inside and outside the company, are fundamental to building a dynamic ecosystem of coexistence within our communities. It is essential that we continue to put individuals at the centre, through direct support by means of the Welfare Reconnect programme.

.JPG_h=9478a396&itok=IuW6kbD9.jpeg)