Now more than ever, it is essential that our people remain well connected across our business. Digital communities and how they interact have become increasingly important and have never been richer, more vibrant, and more impactful on people’s daily experiences than they are now. In line with our ambition of being the bank of Europe’s future, we strongly value relating and engaging with virtual communities as well as empowering them by providing the digital tools and resources they need to stay connected with each other.

In an effort to continue transforming our Bank into a more integrated, fast, and digital organisation for our people and our clients, our goal was to invest in building strong social media relationships that evolve, grow and resist the test of time.

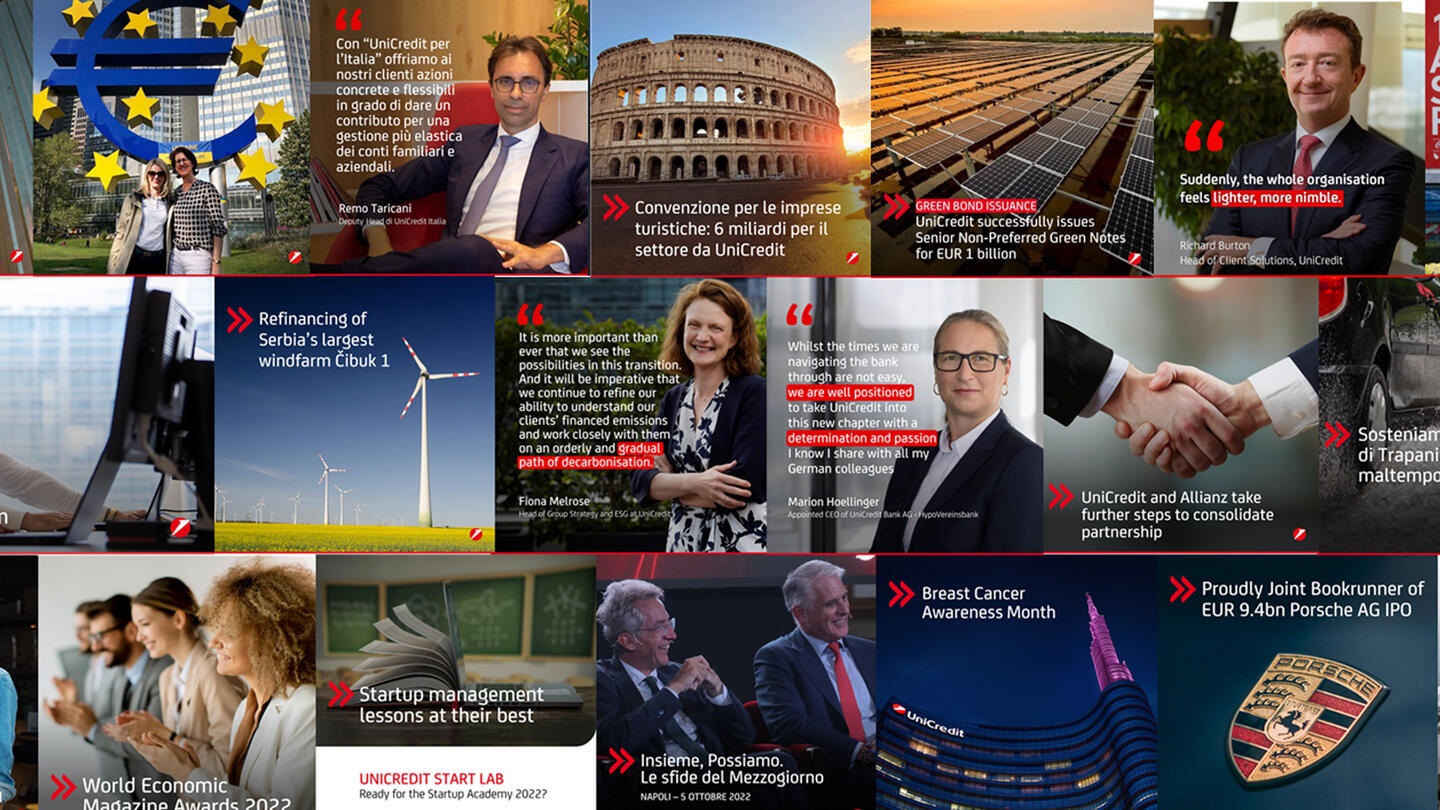

Each market communicates to its audience with the aim of highlighting its own distinctive features while leveraging the strength and the communicative power of a large Group. In this respect, social media and virtual communities have become a key source for intra-company inclusion, building a strong foundation for social relations among our people and with the outside community both in our industry and beyond.

To promote such inclusion through a genuine interaction based on facts, figures and concrete and meaningful actions, UniCredit joined the social media landscape more than a decade ago. We have always valued the importance of connecting and speaking to all our stakeholders across Europe and experimenting with new formats and trends to share insights and unique stories.

To further connect with those communities and reach the younger generation, we opened our @UniCredit_EU global account on Instagram in May. Thanks to an impactful storytelling campaign leveraging images, short videos, and valuable financial tips, we have been able to reinforce the proximity to our clients, communities, and people. One month later, we also launched our first global Facebook profile, another platform offering useful and engaging content to fully discover the potential of an ever-evolving banking institution. To cement these efforts, we drove the importance of our key strategic initiatives through a dedicated Group-wide podcast – featuring key leaders from across our business.

UniCredit’s presence on Instagram and Facebook leverages the creative and engaging tools that the social network makes available – offering followers a vivid and rich dialogue to foster a daily relationship with our Bank, its progress and our digital impact across Europe.

A conversation with...

Joanna Carss, Head of Group Stakeholder Engagement

How did our new social media presence enable us to deliver on our Purpose: Empowering communities to progress?

Joanna Carss,

Head of Group Stakeholder Engagement

There is no doubt that social media has changed how people and businesses communicate in every aspect of our lives. As a Bank, social media provides us with a more direct, personal, and immediate tool to convey our Values, ambition, and commitments. Standing by our customers and communities has always been at the centre of everything we do, and a strong social media presence enables us to remain closer than ever to our stakeholders.

This year we expanded our Digital footprint by offering our clients and stakeholders new platforms to learn more about our business, discover our best-in-class services and products, and follow along our transformation journey first-hand. At the same time, it was an opportunity for our colleagues to actively engage with our Bank, sharing their likes, comments, reposts, and thoughts so we can continue to build a strong cultural foundation for the Group.

Why was this important for UniCredit’s agenda and commitments?

As a pan-European bank, one that operates across several diverse markets as one unified team, we wanted to enhance our presence on the latest social channels to keep us connected to our communities, clients, and colleagues across all our geographies. Our social media presence allowed us to maintain external engagement in-line with the ever-evolving trends of the industry, which proved to be especially critical when we launched our Facebook and Instagram profiles.

Social media provides us with additional channels to collect and share valuable content from across the Group, recognising the teams in our different markets so we could follow along our digital roadmap, celebrate our DE&I and Sustainability wins and achievements, as well as share customer and people success stories. The more we share our stories inside and outside of the Group, the more we can exchange ideas and embrace shared passions – inspiring and accelerating progress for our people to provide them with a top-tier employee experience.

Why are you particularly proud to have worked on this project?

It’s no secret that social media unites people. And people play a pivotal role in the forward progression of our Bank. Each time I see the high engagement of our people on UniCredit’s social media channels – whether it’s a simple “like”, “comment”, or “share” – I am proud to be part of a community of colleagues who are united behind a shared sense of pride in the work they do, and the company they work for.

Ultimately, this type of connection is what has contributed to the transformed UniCredit we see today – a company comprised of highly engaged employees, who are building our better Bank for tomorrow.

And what’s next?

Online habits have clearly changed since the pandemic. Brands must embrace this and find clever and creative ways to understand what’s driving audience behavioural patterns and where your brand fits in the mix.

Digital trends and future predictions talk about the end of a single address and the explosion of multiple digital realities which are fragmenting the user landscape. The challenge brands like UniCredit have is to understand these changing dynamics and be able to welcome them and embed them into their content, formats and tone of voice. I believe financial institutions like UniCredit also need to find ways to simplify their online language, whether it be finding new ways to speak to the younger generation or connecting with clients through real-life content which really speaks to their needs and supports their business challenges.

What is next for us is certainly increasing the way we convey our unique pan-European footprint, engaging and listening more to our online communities, working towards an interest-driven approach which also considers the demographics and peculiarities of our diverse audiences. This might even mean we’ll find a special place to interact with our stakeholders in the Metaverse, become TikTokers or who knows what else the future will bring to social media communications. At UniCredit, we are ready for the online challenge!